The Pros and Cons of In-House vs Outsourcing KYC Solutions

Understanding KYC’s Role in Today’s Business Landscape

Know Your Customer (KYC) is a crucial element in modern business operations. Ensuring KYC compliance means correctly identifying and verifying clients’ identities, which mitigates risks associated with financial crimes and fraudulent activities. Companies today face the challenge of choosing between managing KYC in-house and outsourcing it to a dedicated KYC services provider.

In this article, we will explore the advantages and disadvantages of both approaches, helping businesses select the best KYC solution tailored to their unique requirements.

Table of contents:

- Implementing In-house KYC Measures

- Outsourcing KYC Procedures to Third-party Providers

- Differences Between KYC Outsourcing and In-House Systems

- Advantages and Disadvantages of In-house KYC

- Advantages and Disadvantages of Outsourcing KYC

- Why Choose KYC Outsourcing?

- Conclusion

- Trust Pexly With Your KYC Outsourcing Needs

Implementing In-house KYC Measures

To comply with global anti-money laundering (AML) regulations, such as the Financial Action Task Force (FATF) guidelines, companies adopt policies and measures aimed at identifying and mitigating financial crime risks, including money laundering and terrorist financing. Such risks often arise from inadequate identity verification, leading organizations to establish in-house KYC measures to monitor customer activities.

In-house KYC measures require the formation of a dedicated internal department responsible for ensuring KYC compliance. This department is in charge of customer due diligence, identifying suspicious activities, and reporting them to relevant authorities. In-house KYC systems provide the advantage of more control over the process, enabling businesses to tailor their procedures to specific needs and regulations.

However, managing KYC in-house demands substantial investments in human resources, technology, and training. Companies must hire skilled professionals capable of handling the complex nature of KYC procedures and invest in technology and software to manage vast amounts of data. Furthermore, continuous training and education are vital to keeping the internal department updated on the latest regulations and industry trends.

Outsourcing KYC Procedures to Third-party Providers

Outsourcing KYC processes means enlisting a third-party service provider to handle KYC compliance. These providers possess the expertise, technology, and resources needed to manage the intricate nature of KYC procedures.

One primary reason companies choose to outsource is to eliminate repetitive manual tasks that are labor-intensive and time-consuming. In doing so, they can streamline operations and focus on their core competencies while leaving KYC compliance to experts.

Outsourcing KYC processes also results in cost savings by eliminating substantial investments in human resources, technology, and training.

Additionally, it can lead to more efficient and streamlined processes due to the service provider’s experience and expertise.

Differences Between KYC Outsourcing and In-House Systems

The primary distinction between in-house and outsourced KYC systems is the level of control and customization they offer.

In-house systems provide greater control and customization, while outsourced processes offer more expertise and efficiency.

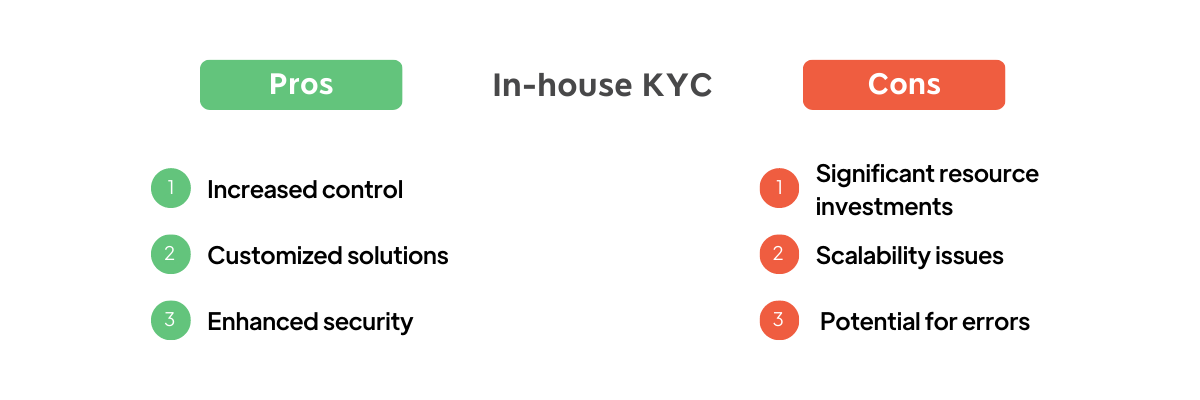

Advantages and Disadvantages of In-house KYC

Pros:

- a) Increased control: By managing KYC internally, companies maintain full control over compliance procedures, addressing unique needs and requirements.

- b) Customized solutions: In-house KYC systems enable businesses to develop tailored solutions that adapt to specific regulations and operational circumstances.

- c) Enhanced security: By keeping the KYC process in-house, companies can manage their security infrastructure, ensuring the protection of sensitive customer information.

Cons:

- a) Significant resource investments: In-house KYC management requires substantial investments in human resources, technology, and training to stay updated with the latest regulations and industry trends.

- b) Scalability issues: As a company grows, managing KYC internally may become increasingly complex and resource-intensive, affecting the business’s scalability.

- c) Potential for errors: In-house KYC teams might be more prone to mistakes without automated systems or access to the latest data sources, leading to compliance issues and vulnerabilities.

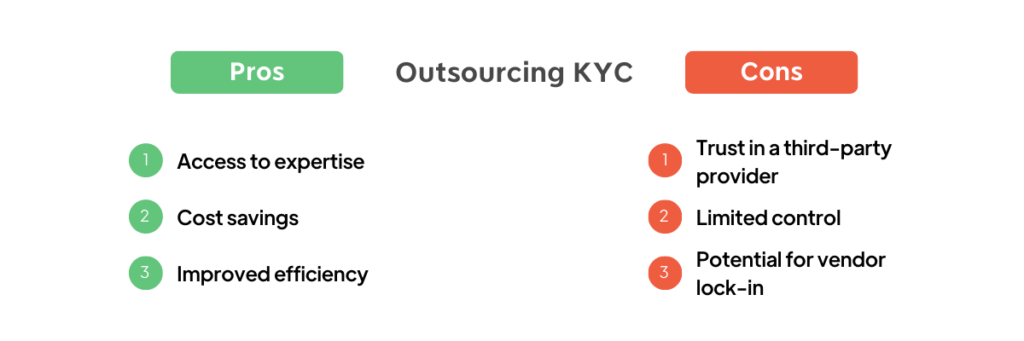

Advantages and Disadvantages of Outsourcing KYC

Pros:

- a) Access to expertise: Outsourcing KYC processes to a reputable provider grants businesses access to expert knowledge and experience, ensuring efficient and effective compliance management

- b) Cost savings: Outsourcing KYC allows companies to save on expenses related to hiring and training staff, as well as the acquisition and maintenance of technology and infrastructure.

- c) Improved efficiency: KYC service providers often have access to advanced technologies and up-to-date databases, enabling faster and more accurate identity verification processes.

Cons:

- a) Trust in a third-party provider: Relying on an external partner for KYC processes requires trust in the provider’s ability to maintain data security and handle sensitive customer information responsibly.

- b) Limited control: Outsourcing KYC may result in reduced control over compliance procedures, which could impact a company’s ability to tailor solutions to its unique needs and regulations.

- c) Potential for vendor lock-in: Outsourcing KYC to a single provider may create dependence on that provider, which could be challenging to address if the need arises to switch providers or bring the process back in-house.

Why Choose KYC Outsourcing?

KYC outsourcing is an ideal solution for businesses looking to focus on their core competencies while entrusting KYC compliance to experts. Outsourcing KYC processes offers cost savings, expertise, and greater efficiency. Moreover, it provides access to cutting-edge technology and regulatory compliance.

Conclusion

Both in-house KYC management and outsourced KYC processes have their benefits and drawbacks. However, for companies seeking cost savings, expertise, and more efficient processes, KYC outsourcing is the ideal solution. By outsourcing KYC processes, businesses can concentrate on their core competencies while leaving KYC compliance in expert hands.

Trust Pexly With Your KYC Outsourcing Needs

As a trusted KYC provider, Pexly offers comprehensive and efficient KYC solutions for businesses, ensuring compliance with regulatory demands while streamlining the customer onboarding process. Pexly’s expertise and state-of-the-art technology make it the perfect choice for businesses looking to outsource their KYC processes.

Pexly’s services include identity verification, document verification, AML screening, and biometric verification, catering to each business’s specific needs. By partnering with Pexly, companies can eliminate the challenges associated with in-house KYC management and benefit from the extensive experience and resources offered by a leading KYC services provider.

In conclusion, while both in-house and outsourced KYC systems have their pros and cons, outsourcing to a reliable KYC provider like Pexly offers numerous advantages. Businesses can save costs, enhance efficiency, and focus on their core competencies while ensuring full compliance with ever-evolving KYC and AML regulations.